Regent House, 12 Wilberforce Street

October 1, 2025

October 1, 2025

August 28, 2025

Kreston Global is pleased to announce the opening of a new member firm in Luanda, Angola, marking a significant expansion of the network’s presence in the region and reinforcing its commitment to supporting clients across Africa.

This new venture is established in conjunction with Kreston Mozambique and will be overseen by Dev Pydannah, Managing Partner of Kreston Mozambique, ensuring alignment in service quality, technical standards, and regional client needs. The Angola firm will offer audit, advisory and tax services, leveraging Kreston’s global reach while serving clients operating in Angola’s rapidly evolving economy.

“Angola presents important opportunities for our clients across sectors, and the establishment of our presence here reflects Kreston’s strategy to strengthen our African network,” said Dev Pydannah. “We look forward to working closely with our clients in Angola, providing them with the trusted, relationship-led advisory and compliance services they need to succeed.”

The Angola firm will also enhance collaboration between Portuguese-speaking economies in Africa within the Kreston network, supporting cross-border projects while maintaining a deep local understanding of regulatory frameworks and market environments.

Liza Robbins, Chief Executive of Kreston Global, commented: “We are delighted to see Kreston’s expansion into Angola, providing further strength to our African coverage and reinforcing our ability to support our clients wherever they do business.”

August 11, 2025

The Kreston Africa regional team has released their first newsletter, packed with important Africa business updates and technical insights relevant to businesses operating across the continent. This edition offers timely insights into regulatory changes and compliance requirements affecting various sectors, helping you stay ahead in a complex and evolving business environment.

Alongside the technical updates, the newsletter includes detailed “Doing Business In” guides for multiple African countries. These guides provide essential information on market entry, local regulations, tax frameworks, and cultural considerations. To support you further, we’ve included direct contact details for our trusted Kreston member firms across the region, ensuring you have expert advice readily available.

To add value for our clients, the newsletter features a selection of free tools designed to simplify your business processes. One highlight is the audit tracker—a practical tool to help manage audit deadlines and improve transparency. These resources are designed to assist you in navigating operational challenges with confidence and ease.

Click here to read the full Kreston Africa regional newsletter and access all technical updates, country guides, contacts, and tools.

Keep up to date with our news, follow us on LinkedIn.

July 3, 2025

The sixth, and final edition of Going Global is now available, spotlighting the mid-market outlook in Africa.

This edition explores how geopolitical shifts, regional reforms, and emerging investment priorities are shaping opportunities for mid-sized businesses across the African region.

Download the latest magazine here.

Kreston Global has offices in over half of Africa and ranks as the 10th largest network in the region. Its Africa network includes 27 firms employing over 1,500 professionals across more than 27 countries. In 2025, the network is set to grow further through strategic additions and expansions in key markets across the continent.

Africa features nine of the top 20 fastest-growing economies, driving strong demand for accounting services, notably in Nigeria where Kreston Pedabo has achieved nearly 70% growth in two years. Angola has also attracted significant investment, inspiring expansion from Mozambique-based Kreston expert Dev Pydannah. In Ethiopia, TAY Audit Service LLP is focusing on youth development, recognising that 70% of the population is under 30.

We explore these themes and more in this edition. You can download the full magazine or browse the individual articles online here:

Follow us on social media

Find more updates on our LinkedIn page here.

Ethiopia is in the top 20 fastest growing economies in the world. Undoubtedly, structural and regulatory development, plus investment have helped the foundations of this consistent growth. However, with 70% of the population under 30, is Gen Z the engine it is running on?

TAY Audit Service LLP, Kreston Global’s member in Ethiopia has a number of initiatives that hope to engage this generation and inspire them to be the next big thing in Ethiopian business. The firm has embedded two major initiatives, designed to support young professionals and budding entrepreneurs in the region.

Launched in 2022, TAY’s internship scheme, now in its 4th round, offers recent graduates in business, finance, natural sciences, and engineering the chance to gain real-world experience in a professional audit environment. Interns take part in live audit engagements, receiving mentorship from senior professionals across industries. The programme bridges the gap between academic study and employability, and successful interns may be invited to apply for junior auditor roles within the firm.

The initiative is free to participants and includes a certificate of completion. While interns are not employees, the programme is designed as a pathway to permanent roles, both at TAY and in the wider professional services market.

In a parallel effort to support self-employment and innovation, TAY is collaborating with the Ethiopian Youth Entrepreneurs Association to deliver tailored training for young entrepreneurs. Launched this year, the programme targets university graduates who are starting or growing their own businesses. Sessions will run both in person and online, with virtual participation available via TAY’s LinkedIn channel.

Together, these two schemes underscore TAY’s commitment to building capacity and supporting sustainable careers for Ethiopia’s youth.

For more information on doing business in Ethiopia, click here.

Africa is investing heavily in its aviation industry as individual nations seek to drive job growth and inward investment. For Angola, a country looking to move its economy away from its dependency on oil and agriculture, a new airport will be the country’s main gateway to the world, and a chance to become an important air hub for Africa.

‘The Dr Antonio Agostinho Neto International Airport (AIAAN), is designed for 15 million passengers annually and 130,000 metric tons of cargo,’ said Dev Pydannah, Managing Director of Kreston Mozambique. ‘To put this into perspective, the five busiest airports in Africa handle 7.5 to 28 million passengers per year. While recognising that the new airport will have a much larger capacity than is needed in 2024, the government considers it to be a bet on the future, hoping to facilitate increased trade within Africa, especially for air cargo.’

The government also intends to develop an airport city around AIAAN, aiming to stimulate economic growth and attract investment to the region.

At the moment, Africa only represents 2 % of global air passengers, according to the International Air Transport Association (IATA) Annual Review for 2024, which means the sector has huge potential for growth. It saw a 39.3% growth in international Revenue Passenger Kilometers (RPK) in 2023 compared to previous year, and a 14.2% year-over-year evolution in air cargo markets, showing that demand is growing.

While just about every sector of African economies will be lifted by aviation growth, e-commerce will be the one to watch. While it may not be as developed as in other regions, the African e-commerce market is growing rapidly. More Africans are gaining access to the internet, expanding the reach of e-commerce platforms and Africa has one of the youngest populations globally, with a significant proportion under 30. Amazon opened operations in South Africa in May 2024, while local e-commerce companies are expanding operations.

Angola itself is finding its economy is on the rebound. After a modest 1% GDP growth in 2023, real GDP grew by 4.1% year-on-year in the first quarter of 2024. This marks the most significant annual expansion in the past nine years. The rebound was driven by a recovery in oil production and a robust performance in the services sector, particularly in domestic trade and transport and storage.

The problem for the Angola economy is its dependency on oil revenue, which has created volatile growth. It needs to diversify its economy away from oil revenues and aviation is a key part of promoting other sectors, from tourism and trade to agriculture and logistics.

It is one of the most stable countries in Africa and it has tremendous potential to become a logistical hub. The new international airport is vital not only for Angola’s economy, but also for supporting the region and continent.

As well as putting the physical infrastructure to boost the economy, the EU-Angola Sustainable Investment Facilitation Agreement (SIFA) came into force in September 2024. The SIFA will create a more transparent, efficient, and predictable business environment for investors in Angola and to promote sustainable investment by EU businesses in Angola.

Angola is on the cusp of exciting times and it offers a wealth of untapped opportunity. Kreston will be on the ground for all these changes, through the extension of its Mozambique office under the leadership of Managing Partner, Dev Pydannah.

Kreston Angola is signing an MOU (Memorandum of Understanding) with a local firm in Angola so that both Kreston Angola and the local firm can collaborate together for the smooth running of the accounting practice.

With the support of Kreston Mozambique, which already works with some clients in Angola, this will add value to the Kreston Angola firm. ‘There is no doubt that we can easily penetrate the Angolan market for professional services such as audit, tax and advisory due to our strong relationship especially being a member firm of Kreston Global,’ said Pydannah. ‘Kreston Angola will work with our clients at all stages of the business lifecycle, whether it be building or managing portfolios, assessing risks, developing exit strategies, realising value, planning to expand or restructuring.’

A significant advantage for Kreston Angola will be the expertise it will be able to tap into to help public sector clients. ‘We are ready to advise the beneficiaries of funds submitted by international multilateral agencies in order to assist them in the global development of their plans,’ said Pydannah. ‘We have worked for government, believe in government and are focused on making it more efficient, transparent and effective. We strive to make government better.’

For more information on doing business in Mozambique, click here.

Nigerian accounting and consulting services are in high demand, with the industry undergoing an evolution toward alignment with global standards. Spearheading this transformation is the Financial Reporting Council of Nigeria (FRC), in partnership with UNCTAD (United Nations Centre for Trade And Development), through the Accounting Development Tool (ADT) project.

This initiative aims to fortify Nigeria’s accounting framework to meet international norms, in an effort to bolster investor confidence and trust in the country’s financial landscape. In addition to promoting financial transparency and elevating the credibility of Nigerian auditors, it also empowers regulatory bodies such as the Financial Reporting Council (FRC). According to Dr. Rabiu Olowo, Chief Executive Officer of the FRC, the deployment of the Accounting Development Tool (ADT) in Nigeria will not only support financial transparency but also reinforce the institutional capacity of the Council.

Dr. Olowo, has acknowledged that the prevailing economic hardship in the country may increase the likelihood of companies manipulating the presentation of their financial reports. However, he affirmed that as regulator, the FRC remains vigilant and committed to discouraging such trends and upholding the integrity of financial reporting in Nigeria. Peter Asemah, Audit Partner at Kreston Pedabo Nigeria, has also said that while the ADT is definitely a step in the right direction, the level of impact it will have depends on how well it is implemented.

‘Having a framework is great, but credibility and transparency do not just come from good policies—they come from strong enforcement and a mindset shift across industries,’ said Peter. ‘One thing I would like to see is a more practical approach to implementation. When problems are identified, there needs to be a clear roadmap with deadlines and measurable outcomes to drive improvement. Greater collaboration between regulators and private sector players—such as audit firms and corporate organisations—would also help make the process more effective.’

He emphasised that education will be crucial to making the Accounting Development Tool easy to implement. ‘If the findings and recommendations simply sit in reports without clear guidance on next steps, adoption will be slow,’ he warned. ‘That is why awareness campaigns, workshops, and even digital tools will be essential. As audit professionals, we also have a role to play in breaking down the requirements for our clients and helping them transition smoothly.’

If everything proceeds as planned, Peter believes that Nigeria could experience a significant boost in investor confidence and overall business transparency. ‘When financial reporting is stronger and more reliable, both local and foreign investors will feel more comfortable injecting capital into Nigerian businesses,’ he explained. ‘We will also see better corporate governance, fewer cases of financial mismanagement, and a stronger business environment. In the long term, this could lead to increased foreign direct investment, improved access to global markets, and even a higher credit rating for the country.’

Nigeria attracts numerous investors in the sector of hydrocarbon, energy, and construction. According to UNCTAD’s World Investment Report 2023, the main sectors attracting FDI inflows into Nigeria include oil and gas, telecommunications, manufacturing, real estate, and agriculture.

Nigeria intends to diversify its economy away from oil by building a competitive manufacturing sector, which should facilitate integration into global value chains and boost productivity. The merging of trade, industry and investment under the ambit of the Federal Ministry of Industry, Trade and Investment reflects Nigeria’s intention to coordinate between these three key areas.

This is creating a business environment full of opportunities for Kreston Pedabo Nigeria and its partners. ‘Businesses will need guidance on how to align with new accounting and reporting standards, and that is where we come in,’ said Peter. ‘We can help clients understand what is changing, how it affects them, and what steps they need to take to ensure compliance, leverage incentives and optimise their performance, particularly with further support from our financial advisory, risk management, and management consulting services.’

Peter is also looking to position the company with regulators to provide training and support for accountants and auditors across Nigeria. ‘As financial reporting standards improve, more multinational companies will be drawn to Nigeria, and that opens up new business opportunities for us,’ he said. ‘It is an exciting time, and we are in a strong position to be at the forefront of these changes.’

June 30, 2025

June 19, 2025

The latest guide to investing in Mauritania from Exco GHA Mauritanie, “Invest in Mauritania” in English. Learn about investment opportunities in sectors with growth potential.

Read the latest Mauritania tax guide.

If you would like advice on investing in Mauritania, please get in touch with one of the experts at Exco GHA Mauritanie.

EXCO GHA Mauritanie has produced a brand new 2025 guide for businesses, individuals, and tax professionals needing to understand Mauritania’s tax structure. Please find the French and English versions below. If you would like to invest in Mauritania, read the latest ‘Invest in Mauritania’ guide.

If you would like to speak to a tax expert in Mauritania, please get in touch.

May 9, 2024

Nigerian inward investment opportunities are varied, buoyed by a large working-age population and abundant natural resources. Boasting a population exceeding 200 million people, Nigeria offers a vast and rapidly growing consumer market. Its strategic location in West Africa provides access to neighbouring countries and regional markets within the Economic Community of West African States (ECOWAS), making it an attractive hub for investors seeking to tap into the broader West African economy.

Endowed with abundant natural resources, including oil, natural gas, minerals, and fertile agricultural land, Nigeria presents diverse investment opportunities across sectors such as energy, mining, agriculture, and manufacturing. By virtue of the sheer numbers and a growing middle class (irrespective of the recent setbacks), other service sectors like hospitality, medical, education, financial technology, and other technology-enabled service drivers (EduTech, AgriTech, MedTech, etc.), equally offer immense investment potential.

Moreover, ongoing efforts by the Nigerian government to diversify the economy away from oil dependence and improve the business environment through regulatory reforms and infrastructure development initiatives further enhance its appeal to foreign investors. With a burgeoning entrepreneurial spirit, a skilled labour force, and a dynamic private sector, Nigeria stands poised to offer lucrative investment prospects for those looking to capitalise on the country’s vast potential and contribute to its economic growth and development.

The Central Bank of Nigeria’s recent announcement regarding an upward revision of the minimum capital requirements for commercial, merchant, and non-interest banks in the country has garnered attention. These new stipulations set higher standards for banks, particularly in the commercial sector, where international operations now require a minimum capitalisation of ₦500 billion (from ₦50 billion), while national operations necessitate ₦200 billion (from ₦25 billion). This development not only impacts the banking landscape but also presents investment opportunities for foreign investors keen on participating in Nigeria’s financial services sector.

Aside from the investment opportunities in the financial services sector, there are several other investment opportunities across various sectors due to the country’s large population, natural resources, and ongoing economic reforms. Some of these opportunities include:

Nigeria is one of the largest oil producers in Africa, presenting significant opportunities for investment in exploration, production, refining, and distribution activities. Additionally, there are opportunities in the natural gas sector, including liquefied natural gas (LNG) projects, gas processing plants, and pipeline infrastructure.

With vast arable land and favourable climatic conditions, Nigeria offers opportunities for investment in commercial agriculture, including crop cultivation, livestock farming, agro-processing, and agricultural technology solutions. There is growing demand for food products, such as rice, wheat, maize, and livestock products, providing opportunities for investors to meet domestic and regional demand.

Nigeria has a significant infrastructure deficit, particularly in transportation, power generation, water supply, and telecommunications. Investment opportunities exist in road and rail projects, airport development, seaport expansion, power plants, renewable energy projects, water treatment facilities, and telecommunications infrastructure.

The Nigerian government is actively promoting industrialisation and diversification of the economy. Investment opportunities exist in sectors such as automotive manufacturing, textile and garment production, pharmaceuticals, chemicals, construction materials, and consumer goods manufacturing.

Nigeria has a rapidly growing ICT sector driven by increasing internet penetration, smartphone adoption, and digital innovation. Investment opportunities exist in telecommunications infrastructure, broadband expansion, software development, e-commerce platforms, fintech solutions, and digital services.

Nigeria’s growing urban population and expanding middle class have created demand for residential, commercial, and industrial real estate developments. Investment opportunities exist in property development, construction projects, affordable housing initiatives, and real estate investment trusts (REITs).

There is a growing demand for healthcare services in Nigeria, driven by population growth, urbanisation, and rising healthcare awareness. Investment opportunities exist in hospitals, clinics, diagnostic centres, pharmaceutical manufacturing, medical equipment supply, telemedicine, and health insurance.

With abundant solar, wind, and hydroelectric resources, Nigeria offers investment opportunities in renewable energy projects, including solar farms, wind farms, mini-grid systems, and off-grid solutions to address the country’s energy access challenges and reduce reliance on fossil fuels.

In conclusion, the above is not an exhaustive list of the inward investment opportunities in Nigeria, as there are more specialised sub-sectors of the aforementioned as well as several auspicious opportunities that arise in response to macroeconomic forces and market occurrences. As such, the African continent – with Nigeria as the largest or repeatedly in the top 3 markets – presents the next frontier for global development prospects, perhaps with admittedly higher risks mostly stemming from insecurity, corruption, and political instability, but also by far, the highest returns possible in similar opportunities in the global North.

If you would like to learn more about investing in Nigeria, please get in touch.

Kayode Oni is an accomplished finance analyst with a proven track record of accounting and consulting. Experienced in finance, accounting, financial analysis, investment appraisal, tax laws and regulations, consulting, project management, and data analytics, Kayode is a valuable asset in the financial sector at Kreston Pedabo.

With over 12 years of experience spanning diverse sectors such as financial services, real estate & hospitality, consumer markets, and oil & gas, Tyna Adediran is a resourceful and self-motivated Business Analyst and Management Consultant. Specialising in areas like Strategy Design & Execution, Project Management, and SME Transformation, she is known for her strong skills in data collection, diagnostics, and critical thinking. Beyond her professional expertise, Tyna is a passionate advocate for continuous learning, sustainable business practices, and youth empowerment, reflecting her commitment to making a positive impact on both the business world and society at large.

Nigeria is a critical force in Africa’s ambitious Agenda 2063, a sweeping blueprint for the continent’s sustainable socio-economic transformation. Nigeria has achieved significant milestones in the plan’s first ten years, Kayode Oni and Tyna Adediran from Kreston Pedabo, explore the integral contributions and the broader implications for international businesses considering African markets.

Agenda 2063 is Africa‘s development blueprint for inclusive and sustainable socioeconomic growth and development. African Heads of State and Governments adopted the continental agenda during the golden jubilee celebrations of the Organisation of African Unity (OAU)/African Union (AU) in May 2013. Agenda 2063 seeks to deliver on seven development aspirations, each with its own goals to move Africa closer to achieving “The Africa We Want.”

The blueprint contains key activities to be carried out in five Ten-Year implementation plans, ensuring that Agenda 2063 delivers quantitative and qualitative transformational outcomes for Africa’s people over a 50-year timeframe.

The implementation of Agenda 2063 at continental, regional, and national levels has progressed steadily during the reporting period. This is attributed to remarkable progress and achievements made towards the realisation of several goals and targets of the First Ten-Year Implementation Plan of Agenda 2063.

The data in the second continental progress report on the implementation of Agenda 2063 indicates that Nigeria has achieved a 40% score concerning the goals set for the seven development aspirations. This marks a significant increase of 208%, up from the 13% recorded in the first continental progress report on implementing Agenda 2063.

Key areas where Nigeria has contributed significantly to the implementation of Agenda 2063 include:

• Increased access to internet and electricity

• Reduced under-five mortality rate

• Increased access to anti-retroviral treatment

• Increased women’s access to sexual and reproductive health services

• Reduced prevalence of underweight among under-five children

• Reduced the proportion of Official Development Assistance (ODA) in the national budget

• Reduced unemployment rates

• Increased real GDP per capita and annual GDP growth rates

• Increased enrolment in pre-primary, primary and secondary schools

• Increase in the proportion of the population with access to safe drinking water and safely managed sanitation services.

• Increase in the share of manufacturing in GDP.

No specific, unified legislation applies to all international businesses looking to expand into Africa. The legal landscape in Africa is diverse, and each country has its own set of laws, regulations, and policies governing international business activities.

However, some regional economic communities in Africa/Trade blocs, such as the Economic Community of West African States (ECOWAS) and the African Continental Free Trade Area (AfCFTA), have taken steps to harmonise certain aspects of business laws among member states to facilitate trade and investment.

International businesses aiming to expand into Africa typically need to navigate a range of legal considerations, including investment laws, taxation, employment laws, industry-specific regulations, trade agreements, intellectual property laws, and local content laws, among others.

Businesses must conduct thorough due diligence and seek legal advice tailored to the country or countries in which they plan to operate. Additionally, regulations and business environments can change, so it is advisable to consult legal experts with the most recent and relevant information.

In Nigeria, however, efforts have been made to attract foreign direct investment (FDI) through its investment promotion agency, the Nigerian Investment Promotion Commission (NIPC). The NIPC Act provides the legal framework for investments in Nigeria and incentivises investors in various sectors.

The Federal Government of Nigeria has adopted rigorous efforts to ensure that areas of concern for foreign investors, such as bureaucratic red tapes, incorporation processes, taxation, capital repatriation, and visa policies, are relaxed to the fullest extent possible to open up Nigeria’s economy to fair competition and prosperity.

Consequently, in line with the NIPC Act 22, the Nigerian Investment Promotion Commission regularly consults with crucial Government agencies to negotiate specific incentive packages in identified strategic areas of investment interest. These consultations have led to an increasingly attractive business environment with tax holidays for pioneer companies producing exportable goods, newly established industries in manufacturing, or expansion of production in sectors vital to the economy. The Government also grants non-tax incentives to non-pioneer firms in addition to industry-specific incentives.

Section 24 of the NIPC Act provides that a foreign investor in an enterprise to which the Act applies shall be guaranteed unconditional transferability of funds through an authorised dealer in a freely convertible currency of:

• dividends or profits (net of taxes) attributable to the investment;

• Payments in respect of loan servicing where a foreign loan has been obtained; and

• The remittances of proceeds (net of all taxes) and other obligations in the case of the sale or liquidation of the enterprise or any interest attributable to the investment.

Foreign investors can set up businesses directly in Free Trade Zones (FTZs) without incorporating a company in the customs territory. Registered companies may also apply as a separate entity to operate in an FTZ that would append the company’s name with the FZE (Free Zone Enterprise) suffix to gain the FTZ benefits.

FTZ incentives include:

• Exemption from all Federal, State, and Local Government Taxes, Rates, and Levies.

• Duty-free importation of capital goods, machinery/components, spare parts, raw materials, and consumable items in the zones.

• 100% foreign ownership of investments.

• 100% repatriation of capital, profits, and dividends.

• Waiver of all import and export licenses.

• One-stop approvals for permits, operating licenses, and incorporation papers.

• Permission to sell 100% of goods into the domestic market (in which case applicable customs duty on imported raw materials shall apply).

• For prohibited items in the customs territory, free zone goods are allowed for sale provided such goods meet the requirement of up to 35% domestic value addition.

• Rent-free land during the first 6 months of construction (for Government-owned zones).

To speak to one of our experts in Nigeria, please get in touch.

May 7, 2024

If you are considering doing business in Africa, Kreston Global is a top 10 ranking network in the region, with a significant presence spanning 28 countries, 27 firms and almost 1400 staff. The network has seen impressive growth, including the recent addition of two new firms in Nigeria and Uganda, contributing to the move from 12th to 10th largest global accounting network in the region for 2024.

The creation of a Kreston Global Africa Committee has augmented an already strong position, with the Committee focused on creating a seamless network in the region. With such a clear vision for the continent, Committee members and their colleagues share their vision for Africa for 2024, highlighting areas for growth, stability and investment.

With East Africa highlighted as the economic engine for the region in 2024, our experts in Ethiopia and Kenya explain what is behind the transformation and how significant investment in banking and telecommunications should ensure the economic boom lasts well beyond 2024.

Our experts also discuss “Green Africa”; Mauritania poised to move away from fossil fuels and towards green hydrogen, the sustainable policies driving change in Morocco and Tunisia and the diversification of Nigeria away from fossil fuels into manufacturing.

We take a look at the challenges South African businesses are facing at the moment, and how risk management can help clients achieve sustainable growth in a turbulent economy.

If you are currently exploring doing business in Africa, our experts, with a clear view of the region’s opportunities and challenges, offer critical insight in our latest regional overview.

If you would like to speak to one of our experts in Africa, please get in touch.

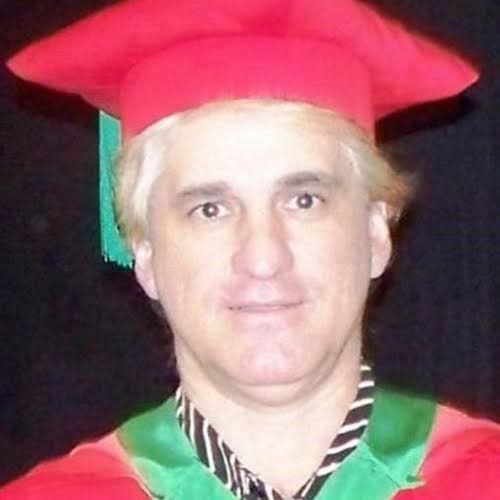

Steven is Research Fellow at the University of the Free State in the School of Accountancy. Steven is the author of several accredited journal articles. His research interests are audit fees, mandatory audit firm rotation and audit reform. Steven has five degrees and qualified as a Chartered Accountant in 1987 after serving 2 years in the South African Air Force. Steven played 7 test matches for the South African indoor soccer team. He was previously a professor at Rhodes University, University of the Witwatersrand and Monash University. He obtained his doctorate in business administration from the University of Kwazulu Natal in 2003.

May 1, 2024

Risk management in South Africa is the ideal tool for sustainable growth in the region, says IFRS Specialist Consultant for Kreston SA Steven Firer.

South Africa has its own unique challenges to growth and if businesses want to thrive, they need to stop following the latest trends and focus on what it takes to survive in South Africa.

South Africa, despite all its resources, is continuing to be a difficult business environment. The latest fears are that if the South African Reserve Bank (SARB) maintains its high-interest rates, the country could experience a recession. South Africa’s economy is grappling with low economic growth and a weakening rand. Investment is slowing – the Johannesburg Stock Exchange has seen a decline in foreign participation over the past five years.

While it is tempting to look at what firms are doing in other countries, Steven Firer (job title) of Kreston SA, warns that local firms need to focus on the trading conditions of South Africa and divert the bulk of their resources to managing them.

‘South Africa’s economy is not slowing down, it is barely surviving,’ said Firer. ‘We have corruption, no electricity, and incompetence. South Africa compared to the rest of the world has different priorities. We have to rid ourselves of corruption, fraud, and incompetency. We have too many reporting rules and regulations in a country that has very few skills.’

Many of the growth areas that accounting and consultancy firms are looking to capitalise on in other parts of the world simply do not apply to South Africa. For instance, Firer pointed out that local companies are delisting from the Stock Exchange as there are simply too many rules and regulations to keep abreast of.

‘For South African companies navigating the landscape of 2024, several key considerations should be at the forefront of their strategic planning, especially given the challenges posed by corruption and competency issues within the country,’ said Firer. ‘These considerations can help companies mitigate risks, capitalise on opportunities, and foster sustainable growth in a complex environment.’

Top of the list should be robust governance and compliance frameworks. ‘Implementing strong governance and compliance structures is paramount,’ said Firer. ‘This involves establishing clear policies and procedures that comply with local and international standards to prevent corrupt practices and ensure ethical business operations.’

In terms of risk management, developing a comprehensive risk management strategy that specifically addresses corruption and operational risks is essential for South African firms. This involves regular risk assessments, the establishment of internal controls, and the adoption of best practices in risk mitigation.

A priority for any firm looking to make a wise investment for its funds over the coming year is in its own staff. ‘Addressing competency issues by investing in employee development, training, and retention strategies is crucial,’ said Firer. ‘Building a skilled and motivated workforce can enhance efficiency, innovation, and resilience against external challenges.’

Improving communication and building relationships with stakeholders and outside organisations is the best thing South African companies can do if they want to build a reputation of trust and credibility in such a difficult environment.

Firer advises companies to prioritise transparency in their operations and decision-making processes. This includes open communication with stakeholders and the implementation of transparent reporting practices to build trust and credibility.

‘Embracing technological solutions can help mitigate the impact of corruption and incompetencies,’ he said. ‘Technologies such as blockchain can offer greater transparency in transactions, while automation and AI can improve operational efficiencies and reduce human error.’

As previously mentioned, South Africa has a lot of rules and regulations and a shortage of professionals who can keep up with them all. Maintaining a proactive relationship with regulatory bodies and staying abreast of changes in legislation and compliance requirements is vital. This includes engaging in dialogue with regulators to understand expectations and to influence policy development positively.

If companies want to stand out from the crowd, they cannot afford to neglect their corporate social responsibility (CSR). ‘Adopting a strong CSR approach and demonstrating ethical leadership can differentiate a company in a challenging market,’ said Firer. ‘This involves committing to social and environmental responsibility, which can improve reputation and stakeholder relations.’

Collaboration, communication and focusing strongly on their own market is the only way South African companies are going to thrive in a very difficult environment.

If you would like to speak to one of our risk management experts in South Africa, please get in touch.

Najat Moughil is a seasoned audit and consulting specialist, known for her expertise in consolidating accounts, implementing IFRS standards, and optimising financial processes. With a strong focus on enhancing internal controls and risk management, she excels in streamlining operations and meeting closing deadlines efficiently. Moughil also offers valuable support in project management, business ownership, and change management initiatives.

In recent years, Morocco has undergone significant transformations, positioning itself as a formidable player on the global stage. This strategic repositioning has not only altered perceptions of the North African nation but has also greatly influenced the landscape for doing business within its borders. Najat Moughil, Partner at Exco ACDEN discusses Morocco’s emergence as a global player has ushered in a wave of opportunities.

Positioned at the crossroads of Europe and Africa, Morocco plays a pivotal role in linking the economies of both continents, fostering trade, investment, and collaboration in various sectors. Morocco is member of the African Union and the leading investor in West Africa. Major Moroccan institutions such as

Attijariwafa Bank, Bank of Africa, and the OCP Group, a leading player in phosphate and fertiliser production, now exert significant influence in Africa.

Concerning Europe, Moroccan exports are primarily aimed at the Old Continent, comprising approximately two-thirds of the country’s total exports. Casablanca Finance City, an economic hub hosting over 200 international companies, is crucial in Morocco’s role as a bridge between Europe

and Africa. Thanks to its geographical location and political stability, strong and modern infrastructures, the implementation of ambitious sectoral strategies, highspeed industrialisation, the development of green energies and the signing of several free trade agreements with the world’s major economic players, Morocco offers a favorable environment for investing in various sectors: aeronautics, automotive, textiles, leather, agri-food and aggrotech, electronics, tourism, information technology, infrastructure and even energy.

In order to strength its position as logistic hub, Morocco made important investments in logistics projects, in ports and railways. In the automotive and aeronautical sectors, Morocco’s logistical role has already grown and investments in production facilities and logistical solutions have been made. Morocco’s automotive industry, aircraft parts manufacturing and mining are traditional industries that offer important export opportunities.

Morocco is also moving forward with various policies to unleash the potential of the private sector, including reform of the vast network of public enterprises and a revision of the investment charter.

The hosting of the 2030 World Cup will provide Morocco with a unique opportunity to extend its influence beyond the continents of Africa and Europe, as the tournament could inject up to US$ 1.2 billion into the Moroccan economy. In preparation, the country plans extensive upgrades to stadiums and

infrastructure, aiming to attract investments through incentives. Tourism is also expected to boom. Banks will benefit from increased infrastructure financing, while the telecoms sector will see higher traffic and investments in 5G technology. Despite the costs, the World Cup offers Morocco a lucrative return on investment and a lasting national legacy. Such a robust economic agenda requires the implementation of

complementary social reforms to ensure its benefits are equitably distributed and accessible.

Amidst efforts to fortify businesses, a parallel consideration arises for initiatives aimed at enhancing the welfare and security of Moroccan households. The efforts have so far focused on the social sectors, with a landmark initiative to expand access to national health insurance and family allowance systems.

In recent months, the Moroccan government has officially launched the registration process for the Direct Social Support program. This program is devised to offer direct aid to families, particularly those in need, including school-age children, children with disabilities, newborns, economically vulnerable families, and

those supporting elderly individuals. The program’s aim to improve socioeconomic conditions will foster economic stability, benefitting businesses operating in the country.

The Moroccan authorities remain committed to an ambitious program of structural reforms designed to put Morocco on a more solid and equitable growth path.

The government’s commitment to social welfare is paralleled by its ambitious environmental agenda. Just as the Direct Social Support program aims to uplift Moroccan households, the “Morocco Offer” seeks to elevate the country’s standing in the renewable energy sector, thereby securing a sustainable future for

all its citizens. On 11 March 2024, the Moroccan government made an official announcement unveiling the “Morocco Offer,” aimed at nurturing the growth of the green hydrogen sector. Prime Minister released a circular outlining a framework of incentives and assistance for potential project developers. This proposition targets investors keen on manufacturing green hydrogen and its byproducts and has attracted approximately a hundred domestic and international investors.

Morocco possesses significant potential for advancing its renewable energy sector, thanks to its abundance of wind and solar energy resources. With the world’s largest photovoltaic plant already in operation, the North African nation is committed to swiftly reducing its carbon footprint. Furthermore, prominent Moroccan companies such as OCP Group, demonstrate remarkable commitment to integrating renewable sources of water and energy into their production processes.

The alternative energies, energy efficiency and the circular economy are becoming the most attractive sectors in Morocco. In 2030, the country aims to reduce its energy consumption by 15% and to reach 52% of renewables in its power capacity.

Morocco’s strategic repositioning as a global player has significantly transformed its business landscape, attracting an influx of international investors. With many projects in progress, such as the gas pipeline between Nigeria and Morocco, the country is poised to become an even more significant player on the global stage.

If you would like to speak to one of our experts in Morocco, please get in touch.

With over 15 years of professional expertise in strategic communications, media engagement, digital branding, and communication for development, Coumba Betty Diallo is a seasoned Communication, Marketing, and Organizational Development Manager at EXCO GHA Mauritania. She brings extensive experience from corporate and digital branding projects, coupled with a track record of successful consultancies both locally and internationally. She offers hands-on support in analysis, strategic campaign development, and event planning management, with a focus on community mobilisation in humanitarian and business sectors. Passionate about volunteering, women’s empowerment, and advocacy for women’s rights, Coumba is dedicated to driving positive change through her work.

New plans have recently been announced to develop a $34 billion green hydrogen project in Mauritania. The country is aware of the current climate challenges, and has taken ambitious steps in energy transition, with a focus on green hydrogen as one of the pillars of its strategy. As climate change continues to threaten populations worldwide, this Sahelian nation has chosen to position itself as a key player in the fight against climate change.

Since the adoption of its national energy transformation strategy in 2020, Mauritania has set clear objectives, including reaching a 60% share of renewable energies in its energy mix by 2030. This approach is in line with its nationally determined contributions (NDCs) under the Paris Agreement.

Mauritania’s energy potential relies on several assets. First, the upcoming exploitation of the offshore Grand Tortue Ahmeyim (GTA) gas field, shared with Senegal, will provide a vital source of liquefied natural gas (LNG) to meet domestic demand and assert itself in the global market. Additionally, the country benefits from a significant potential in renewable energies, particularly solar and wind, with estimated capacities of 457.9 GW and 47 GW respectively.

The challenge of future energies has led Mauritania to explore the potential of green hydrogen.

Preliminary studies have confirmed the viability of this energy source, supported by the country’s

solar and wind resources. In 2021, framework agreements were signed with international companies specialised in energy transition, marking a crucial step in the development of this sector.

The first agreement concluded with CWP Global, aims to develop a project of 30 gigawatts of wind and solar energy, powering electrolyzers for green hydrogen production. This partnership was

reaffirmed at the COP26 climate summit in Glasgow, highlighting the ongoing commitment to this initiative.

The second agreement, signed with Chariot Ltd in partnership with Total Eren, involves the development of the Nour project, covering a vast land and sea area. This ambitious project, aiming to achieve an electrolysis capacity of 10 GW, demonstrates Mauritania’s growing commitment to green hydrogen and its role in global energy transition.

In 2023, these initiatives progressed with concrete steps towards the implementation of green hydrogen projects in Mauritania. International partnerships are strengthening, while feasibility studies are advancing, paving the way for a new energy era for this West African country.

In conclusion, green hydrogen represents a major opportunity for Mauritania to diversify its energy mix, reduce its carbon footprint, and actively contribute to the global fight against climate change.

Through these innovative projects, Mauritania is positioning itself as a regional leader in the transition towards a green and sustainable economy.

Coumba Betty Diallo, Communication, Marketing and Organizational Development Advisor at Exco GHA Mauritanie. If you would like to speak to one of our experts in Mauritania, please get in touch.

Dr George Kimeu is the Managing Partner at Kreston KM in Kenya, a seasoned leader in the accounting sector. His expertise spans business planning, management, risk management, organisational development, and auditing. Dr Kimeu holds a PhD in Organisation Development from Cebu Doctors’ University, Philippines, underscoring his deep commitment to fostering organisational excellence

April 30, 2024

Kenya’s economic outlook looks strong, with East Africa fast becoming the continent’s economic powerhouse, with predictions of rapid growth in 2024 buoyed by tourism, a resilient supply chain and investment in infrastructure such as banking and telecommunications. We spoke to Dr George Kimeu, Managing Partner at Kreston KM in Kenya, to understand his perspective.

Kenya, located in East Africa, is a country known for its diverse culture, stunning landscapes, and vibrant economy. Over the years, Kenya has emerged as one of the key business hubs in Africa, attracting both local and international investors.

Kenya is strategically located as a regional hub for financial, communication, infrastructure, agriculture, and tourism with a fully liberalised economy.

Kenya, like many other countries, was on a recovery path in 2021 before the onset of the Russia-Ukraine war in February 2022. The war disrupted economic activity, leading to a slowdown in economic performance during the second quarter of 2022 onwards. Additionally, the prolonged drought adversely affected economic activity, causing downside risk to the medium-term outlook.

Despite these challenges, the country reported growth in GDP from 4.8% to 5%. This growth was attributed to macroeconomic and political stability and the implementation of the priority projects and programmes under the current government through the Bottom-Up Economic Transformation Agenda (BETA) under the leadership of President Dr. William Ruto, and the country’s long-term development agenda per Kenya’s Vision 2030. The current government’s focus on economic reforms, technology innovation, and diversification of key sectors are some of the key contributors to growth thus creating an enabling business landscape for investors.

Various factors make Kenya the best strategic region for investors. These include:

The digitalisation of government services has made registration of businesses easy through the Government e-citizen portal.

Kenya is famous for its wildlife and stunning landscape, making tourism a key sector of the economy that offers business opportunities in hospitality, tour operations, and ecotourism.

Kenya has and is investing heavily in infrastructure development, including roads, railways, ports, and energy which provides opportunities for investors in infrastructure development, construction, and engineering services.

Other key sectors for investors to consider include agriculture, manufacturing, and ICT. Kenya’s fertile land offers great opportunities for agribusiness, value addition, and agro-processing as the country is a leading producer of tea, coffee, flowers, and vegetables. There are manufacturing opportunities in sectors such as textiles and apparel, food processing, and construction materials. Kenya has a vibrant ICT sector with a growing demand for digital services and solutions which offers opportunities in software development, e-commerce, and cybersecurity.

Kenya is a member of the East African Community (EAC) and the Common Market for Eastern and Southern Africa (COMESA), which has helped to promote trade and economic integration with neighbouring countries. Kenya’s strategic location in East Africa makes it a gateway to the region, offering access to a market of over 200 million people. The participation of Kenya in the new trade agreements such as the African Continental Free Trade Area (AfCFTA), gives the country a competitive advantage due to available opportunities to expand market reach and benefits from reduced trade barriers within the African Continent.

Kenya offers several tax incentives to attract investors and promote economic growth. Some of the key incentives include:

These incentives are key to creating a competitive environment for doing business in Kenya. If you would like to speak to one of our experts in Kenya, please get in touch.

Tesfa Tadesse is the Managing Partner at TAY Authorized Accountants & Auditors, offering extensive expertise in internal and external audits, internal business process analysis, and financial management. With a focus on enhancing internal controls and financial health, Tesfa leads a team dedicated to elevating financial frameworks and providing comprehensive consultancies across East Africa, including Ethiopia, Djibouti, and SomaliLand.

Ethiopia’s fast-growing economy is an African success story and at the centre of that is economic reform and a 10-year plan. Ethiopia has one of the fastest-growing economies in the world and the country is undergoing a huge amount of reform to modernise its economy and attract investors.

Ethiopia is becoming one of the fastest-growing countries in Africa, with an estimated 7.2% growth in FY2022/23. Its strong growth rate builds on a longer-term record of growth over the past 15 years where the country’s economy grew at an average of nearly 10% per year, one of the highest rates in the world.

But the country still has a lot of problems to overcome, the biggest being that its economy is still very much under the control of the state. In an effort to open the region up to foreign investment, Ethiopia is moving toward more private-sector involvement.

To encourage this, the government has launched a 10-Year Development Plan, based on its 2019 Home-Grown Economic Reform Agenda, which runs until 2029/30. It aims to foster efficiency and introduce competition in key sectors such as energy, logistics, and telecoms. It is also focused on solving macroeconomic imbalances such as high inflation, high levels of indebtedness and foreign exchange deficits.

“The Ethiopian economy has faced different challenges emanating from internal conflicts and the impact of climate change,” said Tesfa Tadesse, Managing Partner of TAY Authorized Accountants & Auditors, a Kreston Global firm. “Despite those challenges, there have been some remarkable developments that help fuel growth in the country, particularly in the energy sector. Ethiopia is generating cheap electricity from the hydroelectric stations and has been investing heavily in this sector to unleash the potential. Now the country has started to sell energy to neighbouring countries such as Kenya, Djibouti, and Sudan.”

China stands out as a significant investor, accounting for 60% of new Foreign Direct Investment (FDI) projects approved, with substantial investments in manufacturing and services. Other major investing countries include Saudi Arabia and Turkey. Notable investments include Safaricom’s pledge to invest USD 300 million annually for ten years and the United Kingdom’s Marriott Drilling Group securing financing for the construction of two geothermal power stations in Tulu Moye and Hawassa, which will be the country’s first.

“Ethiopia is also attracting direct foreign investments to the telecom and fintech sectors,” said Tadesse. “Geographically, Ethiopia is in a favourable location to link Africa with the Far East, the Middle East and Europe. The banking sector in the country has been performing exceptionally well in the past 30 years, while the service industry in general is growing and overtook the agriculture sector some years back.”

The country has to make a lot of changes before it can offer a truly favourable investment environment, but it took a significant step forward in January 2024, when it announced it would issue licences to let foreign investment banks operate in the country.

There are currently no investment banks in Ethiopia, and commercial banks are only able to offer limited funding to businesses due to prudential requirements. Businesses are currently paying up to 25% interest on commercial bank funding and have to provide collateral worth 70% of the value of the loan.

The regulator is offering licences to global and regional investment banks, securities brokers and dealers and credit rating services providers who can help businesses list shares on the securities exchange and issue corporate debt.

“In terms of the investment laws and the bureaucracies, there are areas that need improvement,” said Tadesse. “In March 2024, the government lifted almost all of the restricted business areas to allow foreign investors. In the previous law, some business areas were restricted to local investors only. These include import and export business, and retail business including running super-markets. Now the multinational supermarket chains can open branches in Ethiopia.”

Foreign companies now have the right to establish, acquire, own, and divest most types of business enterprises. While private land ownership is currently not permitted, land can be leased for up to 99 years. However, the government recently announced plans to introduce a law that would allow foreigners to own real estate, but there is no date yet as to when the legislation will be brought to parliament.

“The government is also trying to fully liberalise the economy,” said Tadesse. “Foreign exchange control may be eased or fully liberalised. This may have a short-term effect of depreciating the value of the local currency.”

Ethiopia is full of potential and certain sectors, such as Fintech, are poised for a gold rush. If it can ease the growing pains of a reformed economy and currency, it can transform itself.

If you would like to talk to one of our experts about setting up a business in Ethiopia, please get in touch.

April 17, 2024