Canadian tariffs and exit strategies: A tax perspective

Kreston GTA in Canada is inviting colleagues across the Kreston network interested in Canadian tariffs and exit strategies to join the latest instalment of their tax seminar series, led by Bal Katlai, Tax Partner at Kreston GTA.

Non-residents in Belgium to declare taxes online by 22 November

OmniTrust has provided a comprehensive guide to help non-residents in Belgium understand how to declare their taxes online.

Kreston Brighture, China, August newsletter 2024

Kreston Global firm, Brighture, shares its expertise in its latest newsletter covering financial news and updates from China.

OECD’s Pillar 1: Reshaping multinational tax compliance

Mark Taylor, Chair of the Kreston Global Tax Group, provides a critical analysis for FT Adviser on the OECD's guidance regarding amount A, Pillar 1.

Kreston Brighture, China, June newsletter 2024

Kreston Global firm, Brighture, shares its expertise in its latest newsletter covering financial news and updates from China.

Luxembourg firm joins Kreston Global network

Kreston Global has today welcomed Luxembourg firm Global Osiris Audit & Expertise to the Kreston Global network.

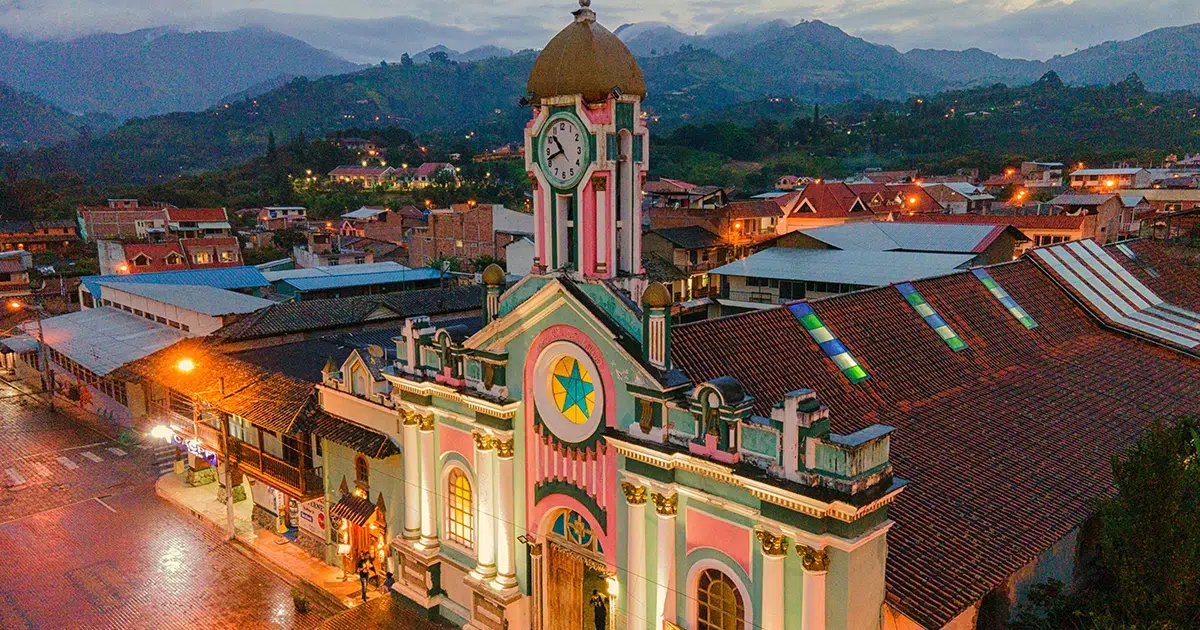

Ecuador hit with VAT increase in 2024

Ecuador will see VAT rates increase in 2024 to tackle a $5 billion deficit, driven in part by a reduction in oil production and increased spending on tackling the country's ongoing unrest. The rise also satisfies a new financing agreement with the International Monetary Fund.

The practitioner’s guide to the OECD Multilateral Convention

Ganesh Ramaswamy was recently featured in an article on the OECD Multilateral Convention for Accounting Today.

Kreston Brighture, China, December newsletter 2023

The December 2023 issue of the Kreston Brighture newsletter delves into recent advancements in financial and tax policies. This section highlights the latest changes, offering insights into their implications for both businesses and individuals.

The Bahamas’ Business Licence Act 2023

Find out how the Bahamas Business Licence Act, 2023, a more comprehensive regulatory framework will affect your Bahamian business.

Understanding the Mexican Federal Revenue Law 2024 update

The Mexican Federal Revenue Law 2024 update by the Mexican Senate is now benefitting from the recently approved Federal Revenue Law for the fiscal year 2024, marking a significant increase in the country's projected revenues.

Kreston Brighture, China, November newsletter 2023

Kreston Global firm, Brighture, shares its expertise in its latest newsletter covering financial news and updates from China.