Doing business in Costa Rica

- How quickly can I set up a business?

- What is the minimum investment needed?

- How can I raise finance?

- What are the legal requirements for setting up my business?

- What structure should I consider?

- What advice can you give me in regards to payroll and taxation requirements?

- Is there anything else that I should know?

How quickly can I set up a business?

5-45 days, depending on the business.

What is the minimum investment needed?

US$ 5.000, depending on the area.

The average investment in Free Trade Zones is US$ 100.000.

How can I raise finance?

Usually, investors contribute the entire capital. Banking finance is available.

What are the legal requirements for setting up my business?

There are no limitations for foreign investment.

If all shareholders are foreigners, the company must appoint a lawyer as a local resident agent.

We can assist you as your local resident agent.

What structure should I consider?

- Branch of a foreign company

- Corporation (open shareholders Sociedad Anonima: S.A.)

- Limited Liability Company (SRL)

- Free Trade Zone Corporations

What advice can you give me in regards to payroll and taxation requirements?

- FTZ corporations must have a proper location. Industrial FTZ parks are available. FTZ Corporations have tax holidays for the first 8 years. Depending on the investment, the period could be extended. Goods and services rendered from FTZ are not levied by VAT

- Branches, Corporations, LLC, and FTZ Co., must be enrolled in a social security payroll, levied by a 26.5% contribution on gross payments to employees. Employees’ labor risk insurance is required and provided by the local INS.

- Regulatory corporate Income Tax is up to 30%.

- VAT is 13% with a monthly report.

- Other minor tax and contributions apply.

- Withholding taxes apply on local income.

Is there anything else that I should know?

FTZ corporations are free to import raw materials, vehicles, and production machinery.

Costa Rica has a territorial principle on income tax. Thus, foreign income from foreign sources are not taxed in the country.

Exports are free of VAT.

Our firms in Costa Rica

See VAT guide

How can Kreston grow your business?

Select your business type:

Latest news

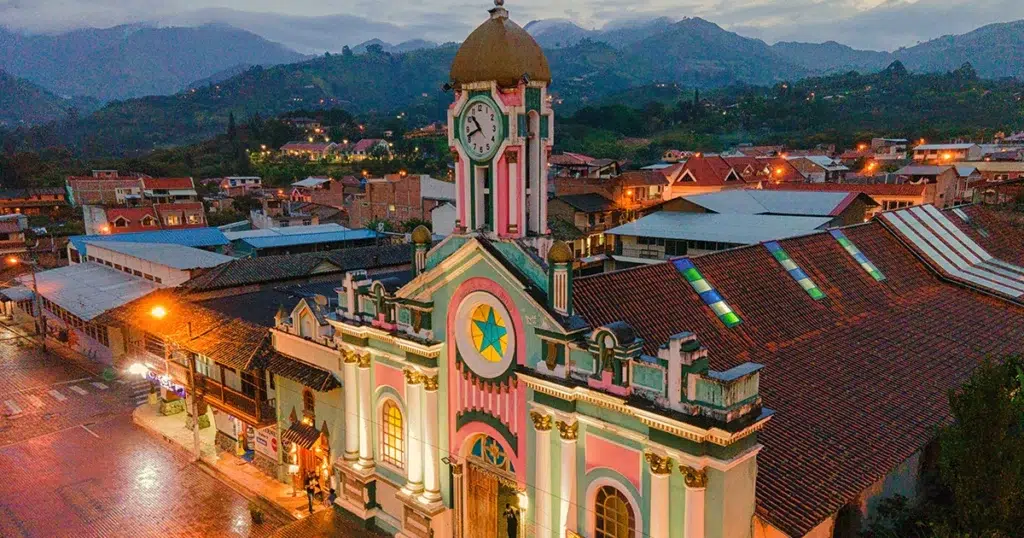

Ecuador hit with VAT increase in 2024

Ecuador will see VAT rates increase in 2024 to tackle a $5 billion deficit, driven in part by a reduction in oil production and increased spending on tackling the country’s ongoing unrest. The rise also satisfies a new financing agreement with the International Monetary Fund.

Kreston Global network welcomes new Argentinian firm

Kreston Global welcomes Kreston BA Argentina to the network.

Understanding the Mexican Federal Revenue Law 2024 update

The Mexican Federal Revenue Law 2024 update by the Mexican Senate is now benefitting from the recently approved Federal Revenue Law for the fiscal year 2024, marking a significant increase in the country’s projected revenues.