Search by keyword

Filter by:

Filter by:

Sort by:

Stop the clock: ESG credentials still critical to mid-market success in Europe

The recent announcement by Kreston Global UK firm, Kreston Reeves, that it is launching new ESG advisory services highlights that strong ESG credentials remain a crucial and relevant service for the mid-market, despite recent deadline delays

Canadian tariffs and exit strategies: A tax perspective

Kreston GTA in Canada is inviting colleagues across the Kreston network interested in Canadian tariffs and exit strategies to join the latest instalment of their tax seminar series, led by Bal Katlai, Tax Partner at Kreston GTA.

DEI in accounting: a key strategy to win over Gen Z talent

In today’s values-driven landscape, the accountancy profession faces a pivotal moment. As Generation Z joins the workforce, their priorities go beyond financial compensation.

Invest in Mauritania

The latest guide to investing in Mauritania from Exco GHA Mauritanie, "Invest in Mauritania" in English. Learn about investment opportunities in sectors with growth potential.

Kreston Global announces new East Caribbean firm

Kreston Global has welcomed a new East Caribbean firm in St Kitts & Nevis, called Kreston Eastern Caribbean, to the Kreston Global network.

OECD Amount B: Transfer pricing safe harbour for multinationals

Kreston Global experts explain how the new OECD Amount B transfer pricing framework will affect multinational distributors and what it means for simplified compliance.

Mid-market outlook in Latin America

The fifth edition of Going Global is now available, spotlighting the mid-market outlook in Latin America.

Auditing digital assets: how auditors can manage risk and compliance

Digital assets are often targeted by cyberattacks. Auditors should review the entity’s network security, incident response plans and any cybersecurity protocols used by external service providers.

New Jordan firm joins Kreston Global

Kreston Global has today welcomed Jordan firm, Alothman Group International (AGI), to the Kreston Global network.

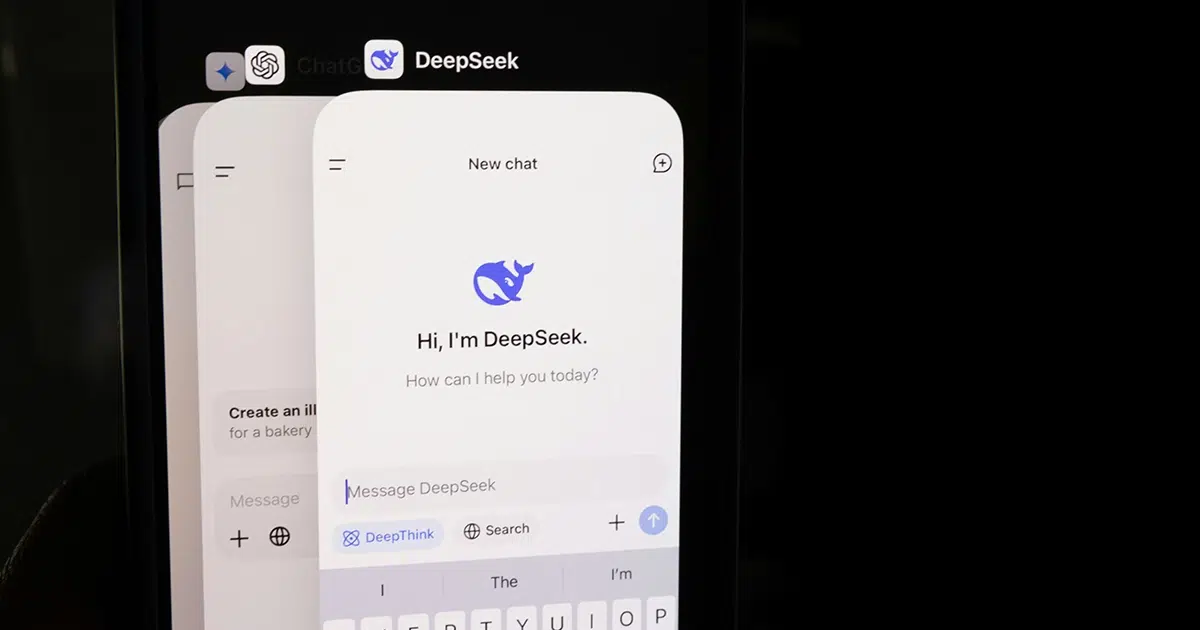

Generative AI in Accounting

Generative AI in accounting is set to be one of the most significant forces shaping the profession in 2025.

Younger Britons see the UK as an attractive destination for foreign firms, says survey on UK market competitiveness

New research from international accounting network Kreston Global highlights UK market competitiveness is perceived more positively by under-35s.

Kreston Middle East Cybersecurity training

Registration is now open for the Kreston Middle East Cybersecurity Conference 2025 covering cybersecurity in audit and assurance.