Kreston Brighture, China, September newsletter 2025

October 30, 2025

Read the latest financial news and updates in China from experts at Kreston Brighture.

October 30, 2025

Read the latest financial news and updates in China from experts at Kreston Brighture.

October 13, 2025

In 2025, US tariffs and the Indian economy hit the headlines, with the U.S.–India trade relationship facing its most dramatic rupture in decades. President Donald Trump’s sweeping tariffs — reaching up to 50% on Indian goods — and a sharp hike in H-1B visa fees sent shockwaves across industries. While headlines focused on textiles, electronics, and auto parts, the deeper story lies in how India’s service sector, especially IT, is responding.

And it’s not just about survival. It’s about transformation.

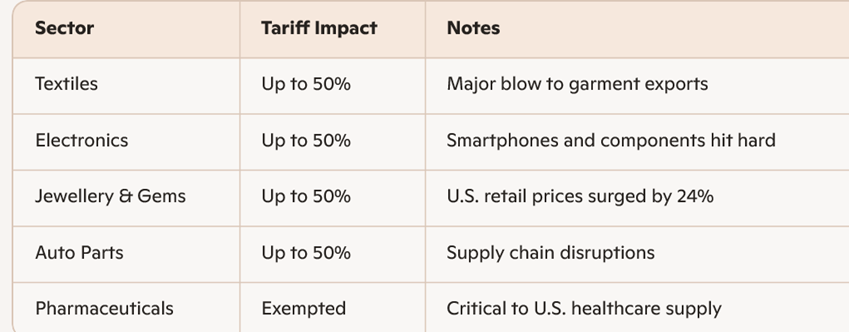

The tariffs disproportionately affected consumer and industrial exports:

India’s IT giants — TCS, Infosys, Wipro, HCL Tech — saw mixed earnings, margin pressures, and client hesitation. Mid-tier firms like Coforge and Persistent Systems, however, outperformed by staying agile and niche-focused.

While the tariffs directly target goods, the services sector—especially IT and business process outsourcing (BPO)—is feeling indirect pressure:

Despite these risks, India’s diversified service export base and strong digital infrastructure offer some insulation. However, analysts caution that prolonged tensions could erode India’s competitive edge in global services.

While the Trump administration’s tariff escalation poses serious challenges, it also opens up strategic opportunities for India to rethink its trade, technology, and diplomatic playbook

India’s resilience lies in its ability to adapt, innovate, and lead. This moment, though turbulent, could be the inflection point for a more self-reliant and globally diversified India.

The U.S. tariff escalation may feel like a setback, but it’s also a wake-up call—a chance for Indian businesses to evolve beyond traditional dependencies and embrace a more resilient, globally agile future. By diversifying markets, investing in innovation, and strengthening digital capabilities, companies can not only weather this storm but also emerge stronger, smarter, and more self-reliant.

This isn’t just damage control—it’s a pivot toward long-term transformation. The world is watching. And it’s India’s moment to rise and redefine the future.

August 11, 2025

Kreston Cambodia has written a summary of the key takeaways of Cambodia’s new Transfer Pricing procedures for 2025.

The Cambodian General Department of Taxation (GDT) has introduced updated transfer pricing (TP) rules through Prakas 574, dated 19 September 2024, to take effect in 2025. The new framework aligns more closely with OECD guidelines and expands the definition of a “related party” to include any entity that directly or indirectly controls, is controlled by, or is under common control with the taxpayer. This includes the relationship between a permanent establishment and its non-resident parent.

“Control” is defined as holding at least 20% of equity interest or voting rights in a company’s board of directors. However, the GDT retains discretion to determine control based on the facts of each case.

The rules mandate that all Cambodian entities engaging in related-party transactions prepare and maintain Local File TP documentation annually. Transactions covered include loans, sales and purchases of goods, leases, royalties, transfers of intangible assets, and technical or management service fees.

Cambodia’s approach adopts the arm’s length principle and recognises OECD-standard TP methods such as Comparable Uncontrolled Price (CUP), Resale Price Method (RPM), and Transactional Net Margin Method (TNMM). While there is no Mutual Agreement Procedure (MAP) in place, disputes can be addressed through the GDT’s local audit mechanism.

Kreston Cambodia’s TP team supports businesses with compliance, including preparing Local File documentation and benchmarking studies; audit defence strategies; audit support leveraging local and international expertise; strategic planning to optimise supply chains and related-party transactions; and tailored advisory services to ensure both compliance and tax efficiency.

Kreston Cambodia is part of the global Kreston network, providing audit, tax, accounting, and advisory services in Phnom Penh and beyond.

For more information, contact Kreston Cambodia at www.krestoncambodia.com.

July 18, 2025

In 2025, the China-US trade relationship—one of the most significant bilateral economic ties globally—underwent substantial turbulence. Tariff policies emerged as a central instrument in the strategic rivalry between the two nations. Over the year, these policies transitioned from a phase of intense confrontation to a period of temporary easing, marked by a series of rapid and substantial adjustments. The frequency and magnitude of these changes represent a rare chapter in global trade history.

A review of China’s official announcements throughout 2025 highlights the escalation and subsequent de-escalation of tariff measures imposed in response to US actions.

Further progress was made in June during negotiations held in London, building on the Geneva Agreement. Two major outcomes emerged:

While these developments provided temporary relief for Chinese enterprises, fundamental disagreements persist. The US maintains a 20% tariff on fentanyl and continues to apply a 10% base tariff across the board. Meanwhile, China upholds restrictions on rare earth element exports. Underlying technological competition between the two countries also remains unresolved.

The ongoing tariff conflict, marked by both escalation and partial resolution, has had far-reaching effects on Chinese businesses. These effects vary by industry and company size and have influenced areas ranging from financial performance to operational strategy. Key impacts include:

1. Export challenges and operational strain

2. Supply chain realignments

3. Heightened uncertainty and compliance burdens

The China-US tariff fluctuations in 2025 posed serious challenges for Chinese enterprises, but they also acted as a catalyst for growth and adaptation. Businesses responded with innovation, supply chain transformation, and market diversification—strategies that will serve them well in an unpredictable global trade landscape.

Looking ahead, it is vital for both China and the US to enhance communication and cooperation. By doing so, they can promote a stable and mutually beneficial trade relationship and contribute to broader global economic prosperity and order.

July 3, 2025

The sixth, and final edition of Going Global is now available, spotlighting the mid-market outlook in Africa.

This edition explores how geopolitical shifts, regional reforms, and emerging investment priorities are shaping opportunities for mid-sized businesses across the African region.

Download the latest magazine here.

Kreston Global has offices in over half of Africa and ranks as the 10th largest network in the region. Its Africa network includes 27 firms employing over 1,500 professionals across more than 27 countries. In 2025, the network is set to grow further through strategic additions and expansions in key markets across the continent.

Africa features nine of the top 20 fastest-growing economies, driving strong demand for accounting services, notably in Nigeria where Kreston Pedabo has achieved nearly 70% growth in two years. Angola has also attracted significant investment, inspiring expansion from Mozambique-based Kreston expert Dev Pydannah. In Ethiopia, TAY Audit Service LLP is focusing on youth development, recognising that 70% of the population is under 30.

We explore these themes and more in this edition. You can download the full magazine or browse the individual articles online here:

Follow us on social media

Find more updates on our LinkedIn page here.

June 19, 2025

April 22, 2025

Minor International is a global leader in the hospitality, restaurant, and lifestyle sectors. With a portfolio spanning over 530 hotels, resorts, and serviced suites, the company operates under renowned brands such as Anantara, AVANI, Oaks, Tivoli, NH Hotels, NH Collection, nhow, and Elewana. Its presence extends across Asia Pacific, the Middle East, Africa, the Indian Ocean, Europe, and the Americas, offering luxury hospitality experiences and exemplary service.

Minor International faced the challenge of conducting internal audits across multiple geographies—including the Maldives, Kenya, Tanzania, and Dubai—without incurring the high costs typically associated with international travel and accommodation for auditors. They required a solution that delivered both local expertise and deep industry insight. Key audit areas included supply chain management, revenue oversight, governance processes, delegation of authority, and IT general controls, all aimed at improving compliance, operational efficiency, and profitability.

The project stemmed from strategic discussions between Kreston OPR’s Vineet Rathi and Kreston Thailand’s Dollawat Promchinavongs during the Kreston Global Groups conference in May 2024. Building on this dialogue, Kreston Thailand’s Bayani Lauraya and Dollawat reached out to Kreston OPR to collaborate on the assignment.

Chintan Upadhyay led the engagement for Kreston OPR, while Dollawat coordinated directly with the client on behalf of Kreston Thailand. Together, the two firms leveraged their regional expertise to deliver high-quality internal audit services across Minor International’s operations in the Middle East and Africa. Despite a slightly reduced scope, the project was executed seamlessly within the agreed timeline and scope.

The internal audit was completed on time and to Minor International’s satisfaction. The collaboration between Kreston OPR and Kreston Thailand was praised for its professionalism, efficiency, and strategic execution. The client expressed interest in continuing the partnership for future internal audit co-sourcing assignments and confirmed Kreston Thailand as their preferred provider for internal audit services.

Minor International said,

“Partnering with Kreston Thailand and Kreston OPR has been an exemplary experience. Their blend of strategic guidance and operational expertise provided valuable insights tailored to our needs. The professionalism, cultural awareness, and results-driven approach demonstrated by both teams were outstanding. We are confident that this collaboration will have a lasting positive impact on our governance and operational processes.”

This is a general guide only and not designed to cover every scenario and the nuances of VAT. Specific advice according to each transaction or supply should always be sought from a VAT specialist.

April 3, 2025

February 6, 2025

January 29, 2025

January 18, 2025

Read the latest financial news and updates in China from experts at Kreston Brighture.

January 9, 2025

December 20, 2024

The accounting industry in Singapore faces a growing talent shortage, driven by rapid technological advancements and the increasing demand for professionals skilled in both traditional practices and modern digital tools. Global business expansion further heightens the need for expertise in international financial standards and regulations. At the same time, shifting workforce expectations, such as a focus on work-life balance and meaningful careers, add to the challenge.

Helmi Talib of Kreston Helmi Talib discusses these issues and Singapore’s strategic initiatives with FutureCFO. Read the full article here, or see the summary below.

To tackle these challenges, the Accounting and Corporate Regulatory Authority (ACRA), supported by Singapore’s Ministry of Finance, established the Accountancy Workforce Review Committee (AWRC) in 2022. Following extensive discussions with over 300 participants, AWRC released a report with recommendations for building a sustainable and skilled talent pipeline for the profession.

Ensure Good Careers, focuses on enhancing the profession’s appeal. Key recommendations include redesigning remuneration structures—already adopted by larger firms and by Kreston Helmi Talib, which updated pay grades and performance-based perks this year.

Advocating for work-life balance and meaningful work has led to government incentives for flexible hours and telecommuting. Additionally, initiatives like the Productivity Solutions Grant (PSG) and Robotic Process Automation (RPA) schemes support SMEs in adopting digital tools, boosting efficiency and morale while enabling better work-life balance.

The second pillar, Create Quality Pathways, focuses on making accountancy careers more accessible. ISCA has streamlined the Singapore Chartered Accountant Qualification (SCAQ), introduced reciprocal arrangements with global CA bodies, and allocated S$15 million to enhance talent development.

This funding supports initiatives like the Accelerated Pathway Program (APP), allowing accounting undergraduates to meet most SCAQ requirements during their studies. Non-accountancy graduates can also pursue certification through a six-module Foundation Program, broadening entry points to the profession.

The third pillar, Strengthen Professional Capabilities, focuses on developing future-ready professionals. Key actions include enhancing the recognition of the Chartered Accountant (CA) Singapore designation and addressing challenges in completing the SCAQ exams. To support candidates, ACRA and ISCA introduced self-study materials, preparatory courses, and partnerships with universities to update curricula with emerging areas of expertise.

Together, these recommendations provide a forward-thinking blueprint for sustainable growth in Singapore’s accountancy profession, equipping it to navigate challenges and seize opportunities in a rapidly evolving landscape.

For more information on doing business in Singapore, click here.

October 18, 2024

October 4, 2024

Kreston Global firm, Brighture, shares its expertise in its latest newsletter covering financial news and updates from China.

September 9, 2024

September 2, 2024

August 21, 2024

In Australia, Mersen Oceania has operated for over 65 years, with Financial Controller Slobodan Brzica, who has 25 years of experience, overseeing the financial operations. Mersen, a global leader in electrical power and advanced materials, has been serving high-tech industries for over 130 years.

When Mersen Oceania sought to appoint a new external auditor, they needed a partner who understood their complex business, provided expert auditing services, and offered value for money. The transition to a new auditing partner was critical, as it had to ensure continuity and compliance with the strict reporting deadlines set by Mersen’s global headquarters.

Bentleys Victoria was selected as the new auditing partner due to its robust auditing expertise. Bentleys Victoria developed a detailed project plan that focused on conducting a comprehensive audit while adhering to the necessary reporting deadlines, incorporating technology to streamline the audit process and established clear timelines to meet all global reporting requirements efficiently. From the outset, Bentleys Victoria demonstrated a deep understanding of Mersen Oceania’s operations and their approach provided valuable insights and recommendations that were well-received by Mersen’s Board of Directors. Slobodan Brzica commented: “Impressive. The team is dynamic and we are pleased with the recommendations and suggested actions.”

A key factor in the success of this partnership has been the continuity of Bentleys Victoria’ team, which has allowed for the retention and sharing of critical knowledge. This consistency ensures that even as team members change, the quality of the audit remains consistently high, supported by a strong technical foundation and an intimate knowledge of Mersen Oceania’s business. Bentleys Victoria successfully met the tight global reporting deadlines, completing the audit within two months. Their efficient and effective service delivery continues to support Mersen Oceania’s commitment to innovation and excellence.

Slobodan Brzica concluded: “The transition was impressive and their understanding of our business was evident from the start. They are a team of real professionals and switched on.”

If you are interested in doing business in Australia, please get in touch.