Christina Tsiarta

Advisory services on sustainability, ESG & climate change, reston Global ESG Committee member

Christina is an experienced consultant specialising in ESG, sustainability, and climate change. She has over 13 years of expertise and has worked with various organisations, including local municipalities, national government agencies, the Directorates-General of the European Commission, and the private sector across different industries.

General Manager and shareholder of consulting companies with a Marketing/ business development and a Financial background with direct experience with several sectors (Real estate, Transport, Fintech, Legaltech, M&A, Import- Export, HR, Restructuring). Exco Polska Board Member.

The Next Generation EU (NGEU) fund impact

January 8, 2024

The Next Generation EU (NGEU) fund could be the key to a more sustainable Europe for small to medium enterprises. We asked Kreston Global ESG Committee members Laurent Le Pajolec from Exco Poland and Christina Tsiarta from Kreston ITH in Cyprus to unpack some of the recent incentives given to countries by the NGEU fund, and how it impacts European businesses.

The Next Generation EU (NGEU) fund recovery package

The Next Generation EU (NGEU) fund is a €750 billion recovery package that aims to help the European Union recover from the COVID-19 pandemic and build a more sustainable and resilient future. The fund includes several incentives, tax credits, and grants that are designed to help small and medium-sized enterprises (SMEs) adopt sustainable business practices.

The Next Generation EU (NGEU) fund mission

One of the primary objectives of the NGEU Fund incentives is to propel Europe toward achieving a net-zero carbon emissions status by 2050, effectively ensuring that the continent emits no more greenhouse gases than it can sequester. Given the considerable cost of financing in Europe, partly due to inflation, it is imperative for companies to access affordable financing options to facilitate their transition toward sustainable and eco-friendly practices, including new investments. Additionally, governments must extend support to facilitate significant investments, particularly in energy infrastructure, to reduce emissions by optimising their energy mix. The urgency surrounding the energy mix transformation was further accentuated by the sharp energy price spikes resulting from the Russia-Ukraine conflict.

According to a Deloitte report from July 2023, 62% of European companies expressed their willingness to embrace mechanisms akin to the NGEU in the face of potential systemic instabilities stemming from geopolitical tensions or energy and environmental crises. The same report indicates that 54% of respondents exhibit optimism about the NGEU’s capacity to steer member states’ economies toward a growth trajectory, enhance their competitiveness, and foster modernization within their nations.

Some venture capitalists and investors have made strategic decisions to fund the Greentech sector. Nevertheless, funding startups, especially at their inception, remains a challenging endeavour. Introducing specialised grants for startups would represent a valuable addition. Given the increasing focus on sustainability and energy mix optimisation, fostering innovation is crucial to ensure compliance with the European Union’s environmental commitments.

As noted by the European Central Bank (ECB), the NGEU mobilises up to €807 billion in current prices in funding, the equivalent of 6% of 2020 EU GDP. €581 billion from this total amount has been requested by EU Member States. Of the seven NGEU programmes, the Recovery and Resilience Facility (RRF) accounts for 90% of the total amount. About half of the RRF funds are made available in the form of non-repayable grants to Member States, while the other half is in the form of loans. More funding was also made available for countries that have been hit hardest by the pandemic crisis, with lower GDP per capita and/or relatively higher debt-to-GDP levels.

RRF (Recovery and Resilience Facility) funding

RRF funding was made available to Member States conditional on the implementation of national recovery and resilience plans (RRPs), which set out concrete investments and reforms aligned with EU guidance for each member state. Each RRP was assessed by the European Commission and approved by the Council of the EU.

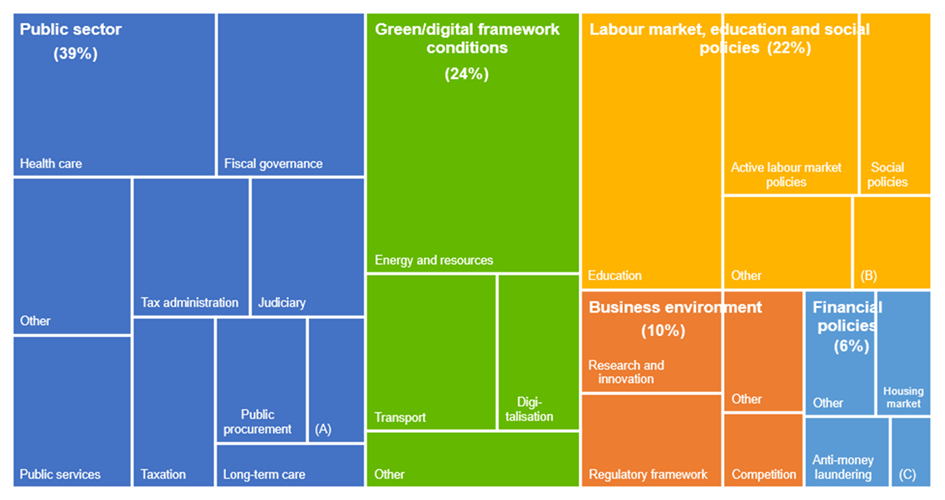

The structural reforms in the RRPs focused on the public sector, framework conditions for the green and digital transitions, and “soft” labour market policies. Therefore via the RRPs, the NGEU fund incentives, tax credits and grants are shaping sustainable business practices in Europe for nations and companies of all sizes, including SMEs.

Green/digital framework conditions, such as eco-friendly revisions of building codes, account for 24% of the reforms. Public sector reforms also support the green and digital transitions, for example by promoting e-governance. Furthermore, the reform plans have the potential to reduce public sector inefficiencies, including resource use (e.g. energy, materials, waste, water, etc.) and improve the framework conditions for private investments into green and digital projects, with trickle-down effects on various areas.

Figure 1 shows the breakdown of RRP reforms in the EU area by policy area.

Source: ECB staff.

Notes: (A) Pensions; (B) Employment protection legislation, framework for labour contracts; (C) Insolvency frameworks. The classification is based on an ECB staff assessment. It has been applied at the level of individual milestones and targets.

Supply value chain

Post-COVID, European businesses are decoupling supply chains away from China, searching for an alternative closer to home. With that, the EU legislation driving ESG reporting has larger businesses looking for good green credentials.

Many companies have chosen to relocate their production to Central and Eastern Europe in recent years given increasing operating costs in the rest of Europe. Many benefits exist for this nearshoring, such as a skilled talent pool, increasingly more fluent in English, growing labour market which means companies do not face a shortage of skilled labour and a lower cost of living, including operating, energy and labour costs, while these regions can boast strict privacy and data security laws for businesses relocating.

Green energy transition

Many Eastern and Central European countries are currently in the midst of an energy transition, with a significant portion of their energy production still reliant on fossil fuels.

According to the Environment Directorate at the OECD, at the ninth Environment for Europe ministerial conference in October 2022, it was noted that even though all the countries in Eastern Europe, the Caucasus and Central Asia (EECCA) have adopted the 2030 Agenda for Sustainable Development and the Paris Agreement and translated them into national strategies and policies, the pace of progress towards a green economy has not been fast enough. The region’s CO2 and energy productivity are much lower than the EU averages. Exposure of the population to fine particulate matter (PM2.5) remains high with associated premature deaths due to PM2.5 pollution. Lack of progress has often been due to political instability or ongoing conflicts, which stifle policy reforms and implementation. So this nearshoring of businesses could affect the ESG landscape across the EU.

Some Eastern European countries, like Poland, which currently rely on a coal-gas energy mix, are actively engaged in ecological transition efforts, including the development of solar, hydro, biogas, and offshore wind projects. Additionally, plans for constructing nuclear power stations are underway to better manage energy resources.

Obstacles to achieving an ecological transition include outdated energy infrastructure and challenges related to obtaining energy agreements and quotas for renewable energy projects, meaning funds like the NGEU are essential to create the infrastructure for change. The energy mix in the region is characterised by a delay in ecological transition. You can view the current energy mix here:

https://app.electricitymaps.com/zone/PL

However, Russia’s war in Ukraine provides an additional reason for accelerating the transition to a green and net-zero economy in these regions, which could benefit all businesses relocating there. Countries are looking into shifting from the reliance on fossil fuel from Russia to renewables due to high and unpredictable prices and supply issues. This will translate into incentives for companies to invest in operating efficiencies and in renewable energy sourcing and production. The green economy transition requires greater co-operation between different sectors and stakeholders, and across levels of governance.

Businesses will benefit from improved relationships with all their stakeholders and enhanced transparency, which could positively impact their brand value. Furthermore, EECCA countries are improving legislation and policy instruments that provide enough incentives for companies to comply with environmental legislation or even go beyond compliance. Part of the financing for this transition will come from public funds and the rest, from the private sector, domestic and international. Businesses will have an opportunity to use these incentives to transition to more sustainable operating practices and to build long-term resilience. All these actions have a positive impact on the ESG landscape across Europe.

Sources :

https://unece.org/sites/default/files/2022-09/ece.nicosia.conf_.2022.inf_.8.pdf

https://www.timedoctor.com/blog/offshoring-to-eastern-europe/

Cheap labour; ethical quandry or business necessity?

European Union (EU) countries are grappling with an ageing population and a significant shift from industrialisation to a service-based economy in Western Europe, which has already led to a notable uptick in salary inflation.

Traditionally Eastern Europe, with lower variable costs, has been much more competitive, but with labour shortages, particularly in emerging industries, and stringent labour codes, wages have started to creep up. An illustrative example is the substantial increase in Poland’s minimum wage, which has surged from 500 EUR in 2017 to approximately 1,000 EUR starting from January 1, 2024.

Resource efficiency

In the context of the EU Taxonomy, which is indispensable for advancing ecological transition and aligning with the EU’s climate-related commitments, the primary determinants of a successful nearshoring process are the composition of the energy mix and a focus on resource efficiency. This approach is vital to meeting CO2 reduction targets and ensuring that the local population benefits from such initiatives.

To an extent, cheaper labour costs are the result of doing business in a country with a lower cost of living and lower operating costs. While this can also be the result of lax legislation, this does not appear to be the case in Central and Eastern Europe.

Eastern Europe national ESG targets

According to the OECD and Green Action Task Force, many countries of Eastern Europe, the Caucasus and Central Asia (EECCA) have set and updated national targets to guide their transition towards a green economy, including on environmental protection, climate change and natural resource management.

All EECCA countries have adopted their national targets of climate action through their Nationally Determined Contributions (NDCs). There has been progress on the development of national-level environmental policy frameworks in the region, accompanied by the creation of several inter-ministerial co-ordination mechanisms.

Furthermore, environmental ministries and agencies in some EECCA countries have been strengthened in terms of their remits and responsibilities. EECCA countries have integrated green stimulus measures into their response to the COVID-19 pandemic and their broader recovery packages. Finally, while capital markets in EECCA countries are not yet contributing significantly to financing green investments, green bonds are also becoming an asset class in their own right. In line with those policy reforms, several indicators have shown signs of progress in resource productivity and environmental quality in the EECCA region.

Mutual benefit

So while significant improvement is still needed, the cheaper labour costs do not appear to be the result of lax legislation or unethical operating practices. Quite to the contrary, it appears that in the EECCA region, businesses will be able to benefit from cheaper labour costs while moving to greener and ethical production practices.

Source :

If you would like to talk to one of our experts about accessing ESG funds in Europe for your business, please get in touch.